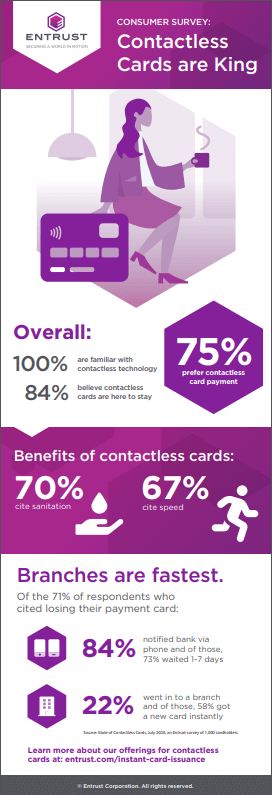

Chip. Swipe. Mobile. Cash. Tap. Is there really much of a difference between the many ways to pay for things like groceries, dry cleaning, or gas? According to our recent survey, the State of Contactless Cards, the answer is a resounding YES! It was revealed that tap (or contactless card) is the preferred method of payment for 75% of the 1,000 US-based consumers surveyed. (FYI, 100% of those surveyed said they’re familiar with contactless technology.)

In the time of COVID-19, that’s not a big surprise. After all, contactless cards mean no handling bills or coins (even non-germaphobes are wary of cash right now), no touching buttons or card readers, no handing your card to or getting it back from a cashier. In fact, a large number of establishments have a no-cash policy right now.

But what about beyond the pandemic? According to our survey, an overwhelming majority (83%) of respondents believe contactless cards are here to stay and 61% believe it’s at least somewhat of a priority to have a contactless feature on their credit or debit card.

Participants cited sanitation (70%) and speed (67%) as benefits of contactless cards, yet the majority of American consumers remain unaware of their card replacement options should they be lost or stolen. Now more than ever, with economic uncertainty at the forefront of everyone’s minds, having immediate — and safe — access to funds is crucial. It’s time for banks to educate their customers on the benefits and possibilities of instant card issuance.

Additionally, for customers looking to replace a lost or stolen card, it’s fastest to do so at a branch. Of the 71% of respondents who cited losing their payment card, an overwhelming 84% notified their bank via phone while only 22% visited a physical bank branch in hopes of getting a replacement card right away. That said, 73% of respondents who notified the bank by phone had to wait 1-7 days to receive a new card yet 58% who visited a branch got a new card instantly.

And though contactless cards are growing in popularity, many consumers are unaware of whether their banks or credit unions offer instant issuance or replacement of debit or credit cards. About two-thirds said their banks offer instant card issuance (64%) and replacement (63%), yet around one-fourth were unsure if their bank offered these options (27% and 24%, respectively), suggesting there’s a sizeable opportunity for banks to educate customers about card issuance solutions.

Here are some survey results at a glance:

Learn more about instant issuance solutions.